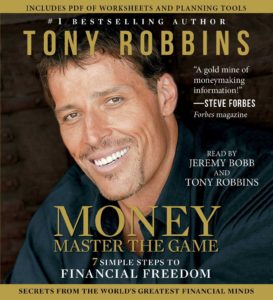

I recently read a fantastic book titled “Money Master the Game” by Tony Robbins. Before reading this book I’d heard Tony Robbins name before, but I wasn’t familiarized with his work. It wasn’t until I was working on creating a class with a medical professional on health and wealth that his name was officially introduced to me. The medical professional told me about a book she was reading which mentioned a lot of the things I’d been talking about. She liked his how direct he was and the fact that he didn’t over complicate things. I’ve read a few books on personal finance and this one sounded like it would probably be more of the same. I honestly didn’t think much about it much after our meeting. About a week or two later I found myself in the library to use the computer and happened to run across the book she had recommended. I have to mention that I found this book in Korea, so the odds that we had a conversation about this book/author and I find the exact book in the library… it spoke to me. I checked out the book and it sat on my kitchen table for about a week before I got around to reading it. I went through the first few chapters and I was hooked. About five or six chapters in I placed an order on Amazon for the book because I knew I had to have it for reference throughout my life. The book is filled with tons of amazing information. Amongst my favorites are the five financial dreams he talks about. I want to discuss them and hopefully get you thinking about what you want your retirement to look like.

Financial Security

To be financially secure you would need enough passive income to pay for the essentials of life. These include housing, food, transportation, utilities, and insurance. Knowing that for the rest of your life you had enough passive income that you wouldn’t have to worry about these things would be awesome and likely make you feel…well… financially secure. Being in the military financial security is almost a given. Just about everything mentioned is paid for. That’s why I believe the military is better than college. But that’s another post. Having this security without needing to work is life-changing. Many people never really think about this and believe in order to live a financially secure life millions upon millions are needed. The reality is that without planning you may wildly chase extraordinarily high numbers. Once you realize how much you spend annually on the necessities you can begin the steps to not just managing your future, but owning it. Does this mean you will never work again? Probably not. However, you would have many more options available to you.

Financial Vitality

This is when you not only have money for the essentials, but also for those things that make spending fun, things like dining-out, a personal clothing budget, personal indulgences or a vacation. These things are also to be funded with passive income, but only half. The other half would come from the job you now have that is less stressful, less time-consuming and brings you fulfillment. Financial vitality gives you more breathing room to provide for yourself and your family. It’s the ability to be more deliberate about your future and be comfortable doing it.

Financial Independence

This is the stage when your money is able to sustain your ideal lifestyle fully. That means you never have to miss another ball game or recital. You won’t have to decide whether you get Christmas or New Years off this year. Take them both! You have the means to decide what you will do with your time. If you have decided to continue working your job because you enjoy it, then do that. If it means working somewhere that pays less than you’re used to, but you have the passion for it…do it! If it means finally starting the business you’ve always wanted then go for it. Financial independence gives you a new lease on life, this is the stage when you are truly free. This is the stage most people think about when they talk retirement. But now that you have a plan and a number, this doesn’t have to be at 65. It can happen sooner rather than later. There are thousands of people who have made it their mission in life to reach financial independence as quickly as possible, I’m one of them. Sometimes all we need is to know which way to go and we can get there.

Financial Freedom.

Remember this is all with passive income. Having financial freedom means you are not only able to maintain your ideal lifestyle, but now through passive income, you are able to live the high life that the rich and famous enjoy. Yep, the boat trips, parties, and private jets. These the lofty visions we have when we daydream. Spending a few weeks in a foreign country or sending your parents on the dream anniversary trip they’ve always wanted. That’s what financial freedom brings. If this isn’t a goal for you then you don’t have to try and reach it. Most people will be content with financial security or vitality, they will both lead to happy lives as they are built on the premise that you have all your needs taken care of and are out of debt which is most important.

Absolute Financial Freedom

Now, this is just that ridiculous money. We’re talking Oprah money. This gives you the ability to not even think about money. Your money is working so hard that you can not only do whatever you want, but you can do what other people want. You get a car…you get a car…you get a car. That kind of money. If this is your goal then go for it. You can make it happen but you have to have a plan.

After reading this book I was able to take a look at the things I wanted to achieve and put them into perspective. Do I want financial freedom or is financial vitality enough for me? What is enough for you? That is the first question you have to answer when it comes to money. Depending on your stage in life one may be more realistic to chase than another. There are those that can never get enough and just making it to financial security will be tough. This should serve as a guide to where you want to be in the future. If you can practice contentment and realize the important things in life already surround you then these dreams become easier to reach. Don’t get so consumed with stuff that all you have to show for a lifetime of work…is stuff.