This is my second post on BRS because it is so soon until the deadline. I can’t really think of a more important military financial issue right now. I thought I’d share some reasons that influenced me to make the switch. Everyone’s situation is different so there may be reasons that you don’t want to switch to BRS and you’ll have to make that determination based on the information that you receive. I will say, I understand not being sure because when the system was announced I was confused too. Knowing what I know about personal finance and how little education is offered I’m not surprised that less than 40% of the military has yet to decided whether to opt-in or stay out at this point. So here are a few reasons that I decided to push the button:

Flexibility

In the Air Force, we say “the key to air power is flexibility”; this is so true. You have to be willing to flex in order to accomplish the mission. That is true when accomplishing your financial mission as well. I honestly have aspirations to stay in the military for 30 years. My grandfather retired from the army and my father served 28 years faithfully. Service runs deep in my family and retiring from the military was the only outcome I envisioned when I joined. The reality, however, is that less than 1/5 make it to the finish line according to the DoD. Medical issues, force reductions, and life changes are things we can’t foresee 20 years down the road. We can’t even see 20 days down the road. So when I see an opportunity to have more control over my situation I would rather take it. BRS allows me to serve on my terms, which is rare for the military to be frank. I don’t want to stay in the military to the point in my career just because 20 is on the horizon, or have to put another opportunity that may come up on hold or completely pass one up because I’m locked into an “I have to finish this first” mindset. This may sound like I don’t want to stay in, but I honestly LOVE being in the military and have plans to stay in as long as I can. In the case that I don’t/can’t it will be nice to know that I have been set up with a nice retirement income.

Saves against me

It’s a fact that when saving is automated we (humans) win. We aren’t really good at saving. It’s so important to say that I wanted to repeat it. Our national savings rate is less than 7% with a majority of workers saving a whopping 3% toward retirement according to the federal reserve. 3% compounding is something, but it won’t get you to a dignified retirement. Having money set aside for us in a retirement account such as the TSP where we don’t get full access to it until 59½ has proven to make the difference in retirement income. Now there is ample data that shows more and more people are dipping into retirement funds and pulling out money, but that is likely because there is a lack of education and we have really been through some really difficult time financially as a country. I’ll speak more on that in another post. But my main point having money that is set aside in an account that you don’t have access to tends to save us from ourselves.

Time is the key to wealth

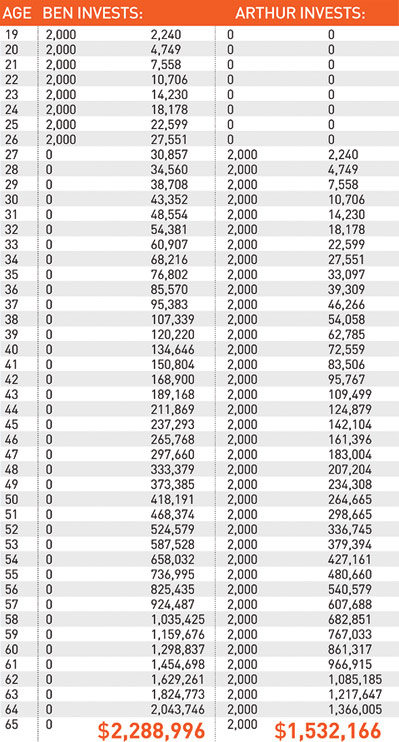

Starting young has been proven to be more beneficial than savings rate. Here’s a visual breakdown to underscore the point.

The rate or return may be a bit high, but the point is the same. However, you see there is less work you have to do when you are young than when you are older. You have to spend more dollars playing catch up and you never really come out on top. I understand that having my money now and letting it work to gain “experience” will make it soooo much more valuable in the future. I often hear people say they will invest the additional money they make by not switching to BRS. First of all…no you won’t. Second, if you do (refer back to number one) you will miss out on what’s called opportunity cost as depicted in the image above. The less time your money is gaining “experience” the weaker it will be when you go to deploy it. It pretty straight forward.

Continuation pay

This is a huge benefit for someone like me that wants to stay in. I look at this as just another free pot of money that I’m going to get for doing what I planed anyway. In 6 years (for me) the military is going to give me 2½ months worth of pay. YES, I will take that. That money is mine. It can go to anything I want. I already know, I’ll get my income taxes around March and in July I’ll get my continuation pay. 2024 is gonna be a fun.

I still get a guaranteed check

Finally, I will still be getting a check for the rest of my life. 2.5% vs 2% that’s what most people focus on and it’s what I looked at first. For my situation, it wasn’t really that big of a deal because once I started thinking about the things mentioned above .005 didn’t compare to the rest. I also look at how pensions are evaporating in the country. I AM NOT SAYING THIS IS GOING TO HAPPEN. But the pension is a defined benefit and the government can take it away at any time. This has happened in the public sector before. Before the late 70’s early 80’s 401K’s were not commonplace and every job basically offered a pension. This is now few and far between with the military being one of the last holdouts. Again I’m not saying it’s going away, but the money they give me up front certainly won’t be taken away.

Hopefully, this has given you an understanding on why I decided to jump into BRS and probably answer some questions. As always if you found this interesting or helpful let me know with a comment or by sharing.