I want to share some information about the blended retirement system (BRS) that may still be misunderstood. I bring this up because the deadline is fast approaching (31 Dec 18) and also today a high ranking individual said something in a brief that made me want to clarify.

I’ll admit, I have been advocating for BRS for sometime now and I’m saddened by the information that is put out incorrectly. This often comes from people that are not able to participate in BRS because they are over the 12 year mark. This leads to a “doesn’t effect me so I don’t care” attitude. This attitude is very destructive when you are looked up to by junior members and what you say matters most – whether rooted in fact or opinion. SO to clear things up

1. You still get a pension when you hit 20 years of service

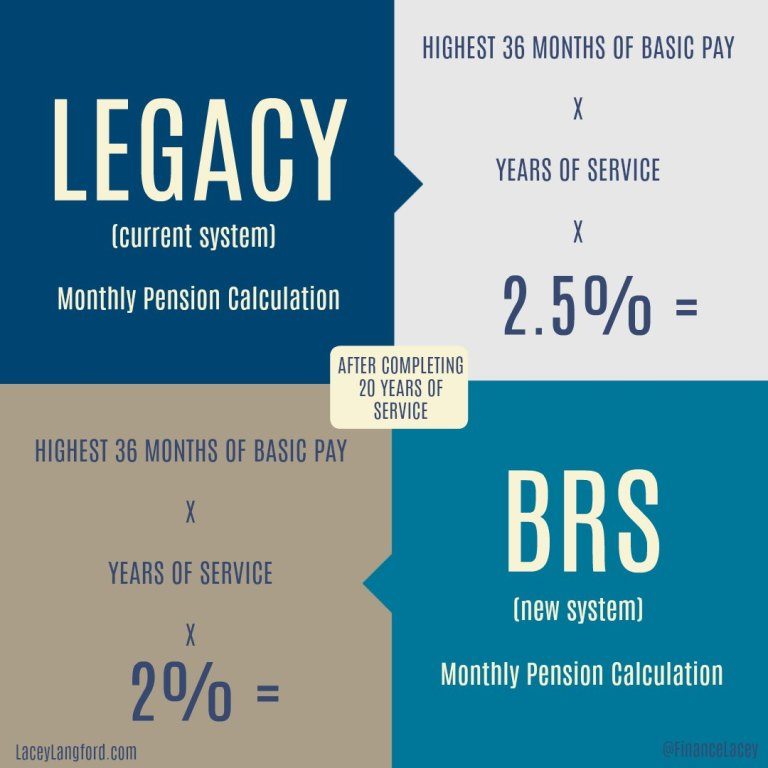

This seems to be the question or gripe about BRS that I hear most often. I heard it twice today. It’s not true! While you will get a reduced amount (2% vs 2.5%) you still get a lifetime pay check when you retire.

2. The window to opt in is not closed

I get this a lot because the BRS opt in date started on 1 Jan 18 and all new people joining would be auto enrolled. But the window will not close until 31 Dec 18 like I said previously.

3. You don’t give up your annual COLA (Adjustment no Allowance)

This was briefed to me in a mass briefing so I will clear it up just in case others heard this too. The annual COLA pay is the payment you receive on the first of every year will not be take away if you elect to do BRS. You will still get your yearly raise at the new year, unless the government decides not to give it to us, but then it will be across the board; not just to those who participate in BRS

4. You have to be contributing to your TSP if you want the 5% match

It is true that you can start BRS, not contribute and still get 1% of your base pay allocated to TSP. However, if you want to get the 5% you have to also contribute 5%. The 5% you put in can be in your Roth or traditional and you will still get the match.

5. You will not get to pull money out of your TSP early

I hear some people floating around the idea that you will be able to withdraw your money from TSP after you separate. This is not true. Well technically it’s true; you can withdraw the money anytime, but it will be heavily taxed, penalized and it would be a bad decision in general. The money you contribute or the match is not yours to touch without fees until 59½. This is the same for BRS and Legacy participates

6. You are *not going to make less money if you choose to opt into BRS.

Now this is dependent on where you are in your career. I have seen only one example of where its not beneficial for someone to switch if they have the opportunity. I look at the whole possibility of money growing and compounding throughout your lifetime to make the assumption (an educated assumption) that you will make more money with BRS than without. You will take an immediate decrease in benefits (2% vs 2.5%) once you retire, but over the long run once you are able to withdraw the money that has grown for 25-35 yrs potentially millions could be waiting. And it very likely that you will have more income coming in from your second career to supplement the .005 that you have given up.

These are just a few thing that I have heard while trying to explain BRS and I wanted to mention them. I believe it is a great system and one that I opted into as soon as I could. The deadline is nearing so get educated ASAP. The sooner you opt in the sooner the money starts to flow (considering you contribute up to the match). I’ll be getting over $1700 this year just from BRS matching contirbutions. Considering that $1700 per year compounded over the next 32 years is over 260K I’ll absolutely take that free dough.

Consider this: A E-7 (legacy) retiring today with 20 years of service would get about $2200 per month and a E-7 (BRS) would get about $1800. After 40 years of collecting that well deserved check the difference is roughly $196K.

A 5 percent match for a E-5 with 6 years in the military and 32 years until retirement age could see around $280K. That’s almost $90K more for the BRS person in the end. Now you may think you could invest the difference you make during retirement from the military, but the lost time won’t allow you to make the up the difference, time is the best contributor when it comes to compound interest. We also tend to suffer from the effect of “hyperbolic discounting” which basically counts on the future you being better than the present you and that is typically not the case.

What have you heard about BRS that doesn’t quite sit right with you? Will you be opting in?

Let me know and if this has helped you be sure to comment and share.

E

18 Oct 2018Thanks for the post! I decided to opt in to BRS, I’m an E-5 with 6 years TIS, one question I do have is what will happen if I decide to get out of the military before 20 years? What happens to with the money I’ve already contributed?

admin

18 Oct 2018One of the benefits of BRS is any money you contribute is yours to keep when you transition from the military, whether you stay 20 years or less. You also get to keep the matching contributions since you meet the time in service (TIS) requirement. But remember to plan because this money will not be available to you until you are 59 & 1/2; however, the money should mature into a nice sum by that point. Make sure you have gone into TSP and managed your funds to get the most out of the system. Thanks for the comment.